In a world where watch prices are increasing every year and the more mass and mainstream luxury brands getting more expensive, we have to ask, are the prices worth it and the price rises justified?

Every year, it seems that most brands are increasing their prices across core model lines or all of their collections. For some brands, they are modest increases, others however do fairly sizable jumps. And for some brands, this isn’t once a year, it’s twice a year. Maybe they think we won’t notice as much with two smaller increases or will forget about the price increase that happened at the start of the year. But trust us, we don’t!

So when this yearly increase happens, it makes some noise, especially with the more well known brands. You can hear the comments that are echoed in forums and chat groups all over the world that go along the lines of “wow, another 8-10% increase by insert brand here!” Or some pundits love to look at the overall increase over a few years, which admittedly looks a lot more when you see some pieces having gone up by 20% since 2020.

If you have a look at the prices from 2020, and you can go back through some of our historical articles for reference, you can see exactly what we’re talking about. As an example, when the new 41mm 124060 Rolex Submariner was introduced in September of 2020, it was $11,400 (AUD) and the Submariner Date, ref.126610 was $12,900 (AUD). Today, just over 3 years later, both these references have gone up to $13,550 and $15,250 respectively. That’s over 18% for each piece in that time. Now I’ve used Rolex as the example here as it’s the most well known, but many, many other brands have done the same thing, and many, like Omega as the nearest competitor to Rolex have gone up a similar amount in the same time.

Now COVID played a massive part in that, with inflation around the world going up rapidly due to staff, supply and product shortages with increased demand in consumer goods. Here in Australia, between Financial Year 2019/20 and the financial year just gone (2022/23) CPI/Inflation was 13.6%, or averaging 4.3 year on year. Thankfully this has slipped back from what was 7% at one point to around 5.2% in August 2023 (Monthly Adjusted) and fingers crossed will fall again to be more reasonable. In saying this, the highs were not seen until early – mid 2022, yet many brands had increased much more than the CPI prior to the inflation going up.

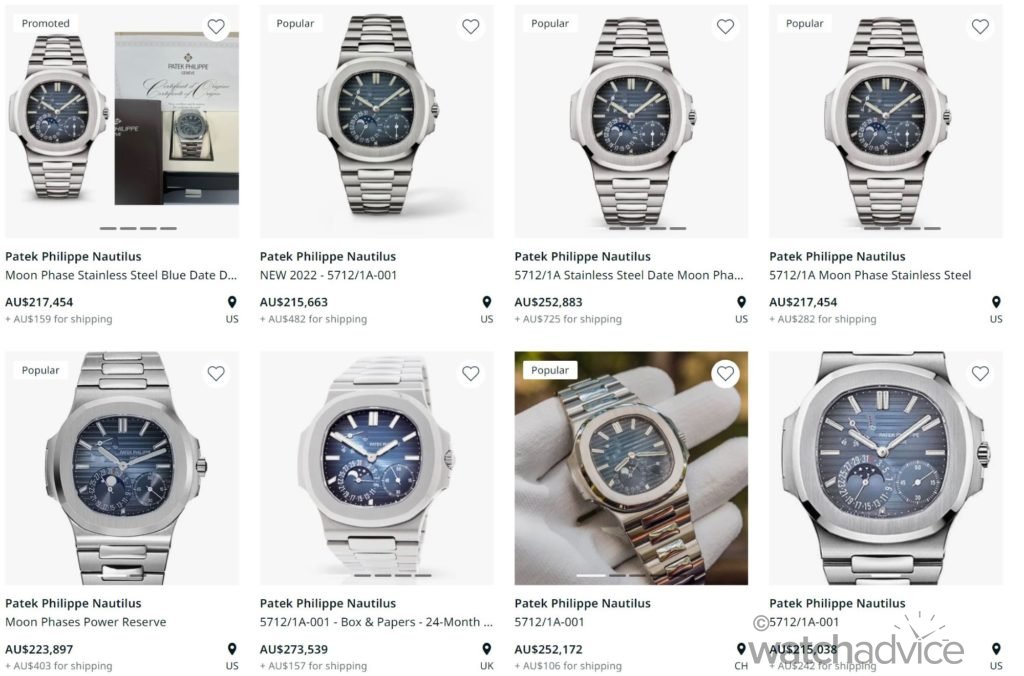

The cynics amongst us will say that much of this was jumping on the watch hype and the halo affect off those brands that went through the roof on the secondary market, and to be honest, they’re probably not all that wrong. Certainly in the case where certain brands and pieces were trading at 2, 3, 4x retail, then this is just making hay whilst the sun shines. If people are willing to pay $50,000 for a $20,000 watch, then for a brand to increase the retail price to say $25,000 or even $30,000 in their mind would be reasonable. After all, people are valuing it at $50,000 so why not charge more as it won’t affect the demand. And the proof is exactly this, the demand is still there for the big 3 (you know who we’re talking about) and the aftermarket is still strong for many of their pieces, albeit a little cooled off from 12 months ago.

Or perhaps the heads of the brands are just great at looking towards the future, which is probably not too far from the truth either. Luxury good’s are (normally) very good at understanding global economic conditions and like any big business, will have some connections with the central banks and also their bank’s economists, not to mention peripheral industries like housing and automotive as examples. In this watch journalist’s former life, I sat through many state of the economy and economic indicator presentations from said banks and key industry players giving their thoughts on where the next 12 months will lead. Trust me, watches are more fun!

So it would stand to reason that as the economy was heating up, and COVID still affecting supply with demand being strong thanks to government grants and wage subsidies for people, you could predict that secondary market prices could rise even further than they had been prior for 2020. Is this fair for us watch enthusiasts? Not really. Is it justified? Potentially depending on your perspective. Will it slow down now? Let’s hope so.

However, there is a third factor here, and this isn’t one that blankets all brands, but some. Whilst brands like Rolex or AP, or Omega haven’t fundamentally changed their product over that time, some brands have. They’ve been developing new movements, new alloys, more refined pieces, coming out with new models that push the boundaries or are out of the box. They’re actual innovation present in their new models which goes a long way to justifying and backing up the new prices.

A large part of a watch brand’s cost base is research and development, material innovation, the materials themselves and also outfitting the manufacturer with the machines needed and the watch makers that know how to put all this together. This means that in a lot of cases, training is also needed. All this costs money and this doesn’t even touch on the costs to bring the piece to market – distribution and transportation, advertising and marketing, retail agreements, sales staff training, collateral updates and the like. That’s just to name some.

This is all baked into the cost of the new model on top of the existing model’s cost and amortised out over X number of years – remember that in the case of brands that have retail partners, the RRP needs to have profit for both the brand selling it to the AD and then the AD needs to make money as well. Ah business! Now this is us being very generalist, as each brand will have many differing factors as well, but this is just to illustrate a point as you quite often here people saying that a watch would only cost a fraction of what they sell it for. And strictly speaking, the cost of the materials may only be a fraction of the retail. But if they were to sell the watch at say 20% more than raw material costs, then you’d probably be picking the pieces up from the manufacture and assembling it yourself. Large scale businesses have massive cost bases and unfortunately when 95% of your revenue comes from one type of product (again, generalising here), then your entire cost base needs to be built into every single watch sold.

So whilst we like to complain about the prices going up, and some people may think that a Rolex or Omega only cost a few hundred dollars to make (yes I’ve seen people say this in the past!) the situation is the situation. It may mean that all of us might have to adjust our buying habits or expectations on what we can set our sights on. After all, luxury isn’t cheap and nor should it be readily obtainable. It should be aspirational and be the exception, not the rule. But most of all, it should say something about you, your personality, style and who your are and thankfully, there are plenty of pieces out there from $1,000 to $100,000 that can do that. Buy what you can afford, what you love and enjoy the journey that is watch collecting!